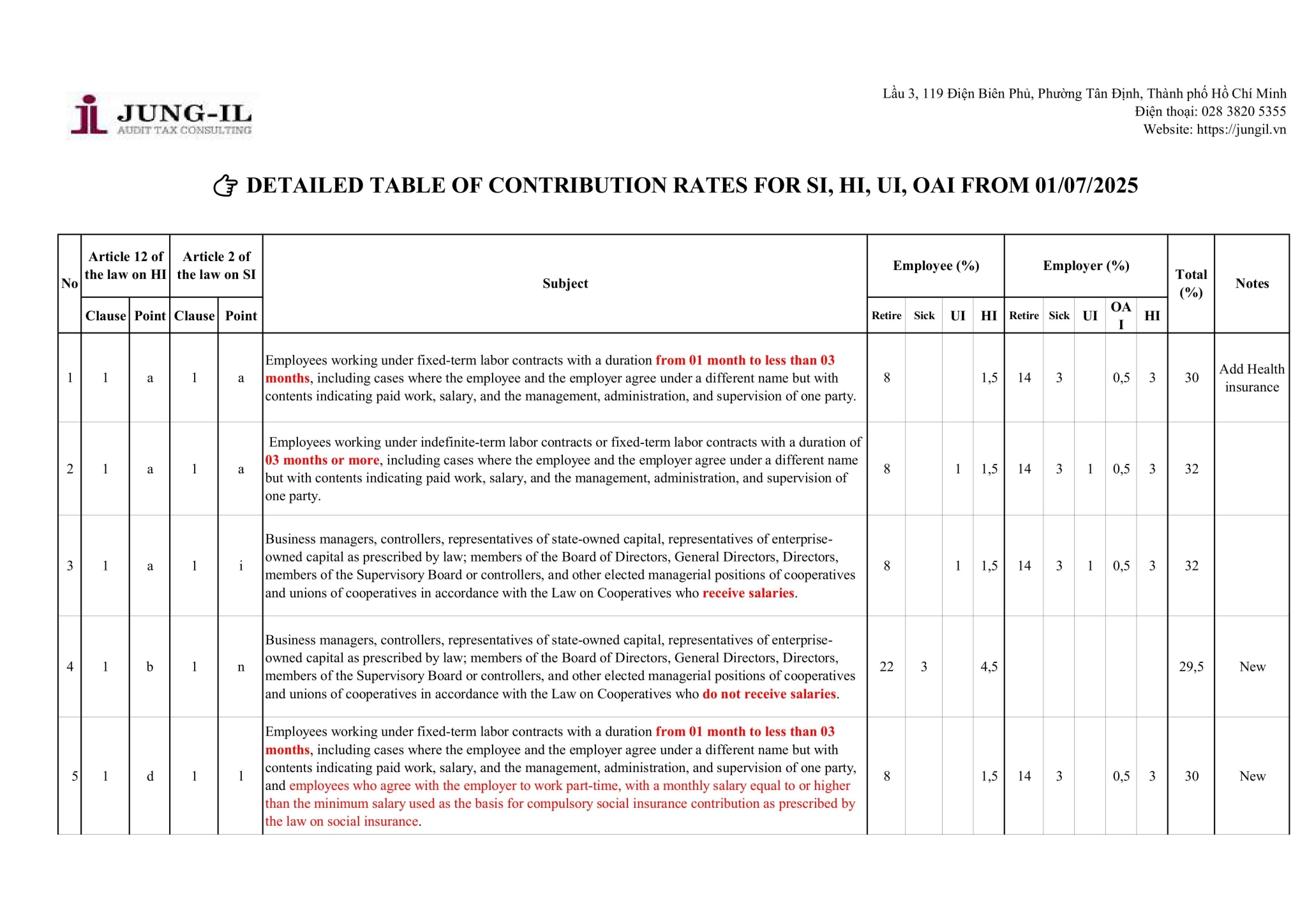

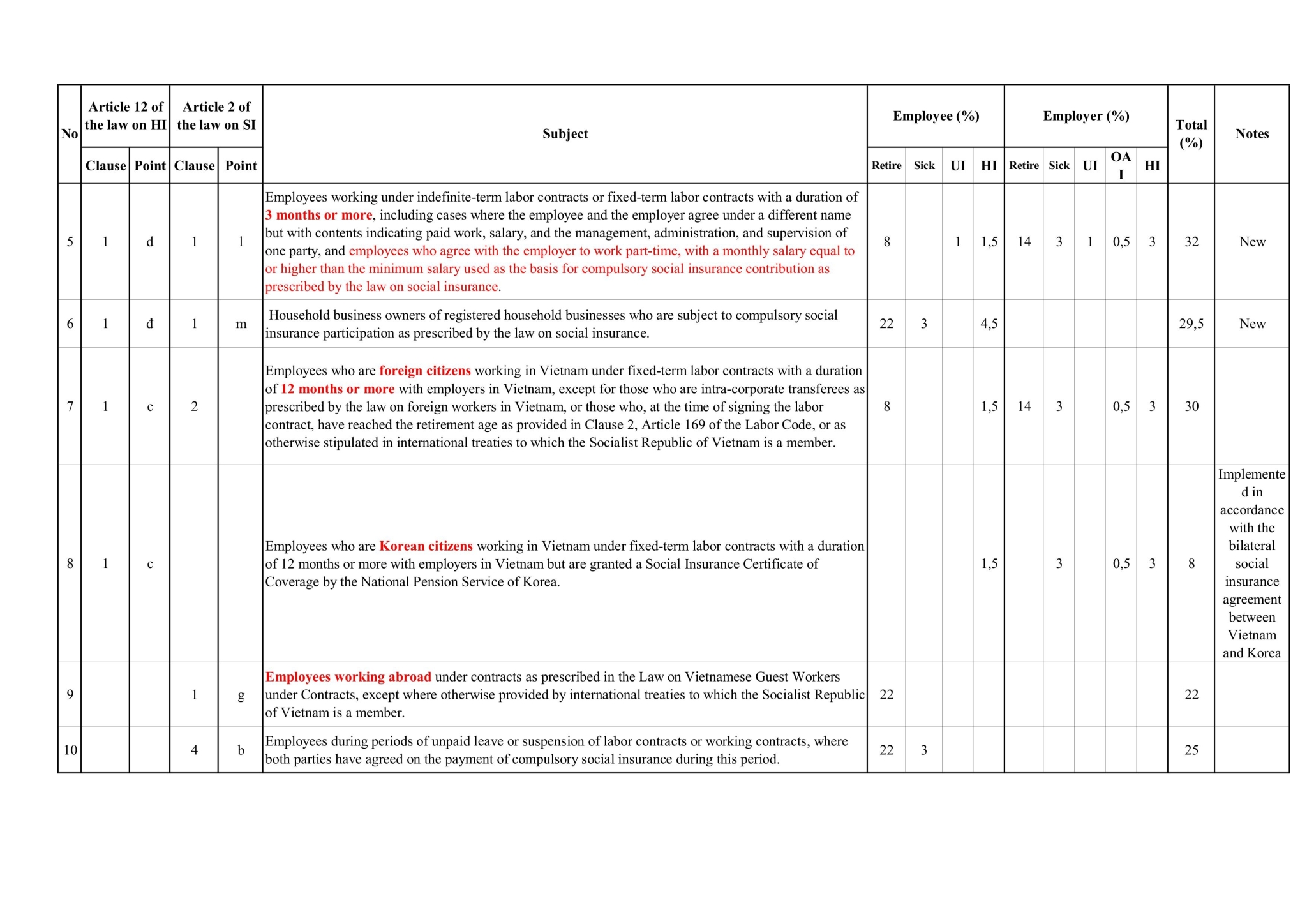

COMPULSORY INSURANCE CONTRIBUTION RATE FROM 01/07/2025

After registering to participate in social insurance (SI), health insurance (HI), unemployment insurance (UI), occupational accident and disease insurance (OAD) for employees, employers are responsible for deducting and paying SI, HI, UI, and OAD to the Insurance Agency according to regulations.

The deadline for payment of social insurance and health insurance premiums from July 1, 2025 is the last day of the following month for monthly payment or the last day of the following month immediately after the payment cycle for payment every 3 months or every 6 months (applicable to employees receiving wages based on products or contracts at enterprises, cooperatives, cooperative unions, and business households operating in the fields of agriculture, forestry, fishery, and salt production) .

Below is the detailed table of social insurance, health insurance, unemployment insurance, and occupational accident and disease insurance contribution rates from July 1, 2025 according to the Social Insurance Law 2024 and the Health Insurance Law 2024 of all social insurance participants.