PERSONAL INCOME TAX FROM SALARY AND WAGES

1.1 For resident individuals:

* For resident individuals signing labor contracts for 03 months or more

Pursuant to the Law on Personal Income Tax 2007 and Articles 7 and 9 of Circular 111/2013/TT-BTC, personal income tax for resident individuals signing labor contracts for 3 months or more is determined according to the following formula:

Personal income tax payable = Taxable income x Tax rate

In there:

Taxable income = Taxable income - Deductions

Taxable income = Gross income - Tax-Exempt incomes

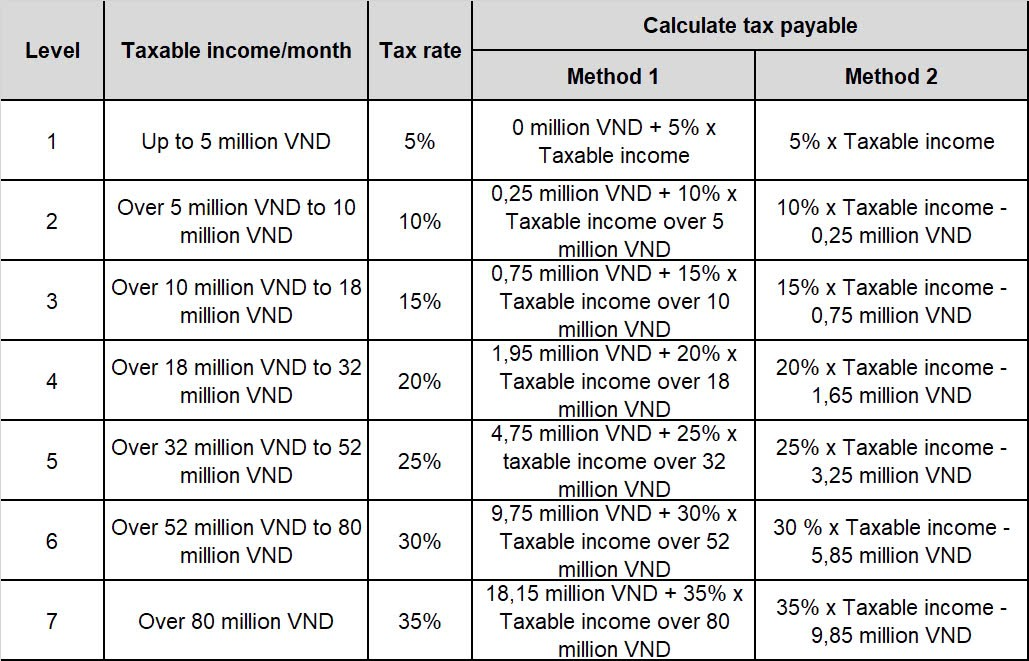

- Tax rate:

Tax rates on salaries and wages for individuals signing labor contracts of 3 months or more are applied in a progressive manner, specifically:

For example:

Mr. K signed a labor contract with company H with income from salary and wages in February 2024 of 30 million VND. The insurance contribution rate (social insurance 8%, health insurance 1.5%, unemployment insurance 1%) is over 20 million VND, Mr. K has a deduction for 1 dependent.

- Mr. K's taxable income is 30 million (no tax-exempt income)

- Deductions: personal deduction 11 million, deduction for 1 dependent 4.4 million, insurance deduction 10.5% x 20 million = 2.1 million. Total deduction = 11 million + 4.4 million + 2.1 million = 17.5 million

- Taxable income = 30 million - 17.5 million = 12.5 million

Thus, Mr. K's taxable income belongs to level 3 according to the above tax table.

- Personal income tax = 0.75 million + 15% x 2.5 million = 1.125 million

Or personal income tax = 15% x 12.5 million - 0.75 million = 1.125 million

* Not signing a labor contract or signing a labor contract for less than 03 months

Pursuant to Point i, Clause 1, Article 25 of Circular 111/2013/TT-BTC, resident individuals who sign labor contracts for less than 3 months or do not sign labor contracts but have a total income payment of 2 million VND/time or more must deduct tax at a rate of 10% on income (deducted before payment).

In other words, individuals who do not sign a labor contract or sign a labor contract for less than 03 months but have income from salary and wages of 02 million VND or more each time must pay tax at a rate of 10%, except in cases where they make a commitment according to Form 08/CK-TNCN if eligible.

The tax payable is calculated as follows:

Personal income tax payable = 10% x Total income before payment

1.2 For non-resident individuals

According to Article 18 of Circular 111/2013/TT-BTC, personal income tax on income from salaries and wages of non-resident individuals is determined as follows:

Personal income tax payable = Taxable income from salary, wages x Tax rate (20%).

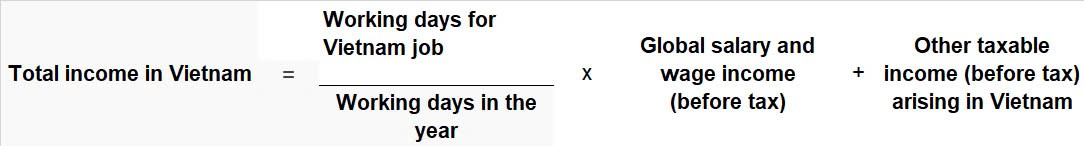

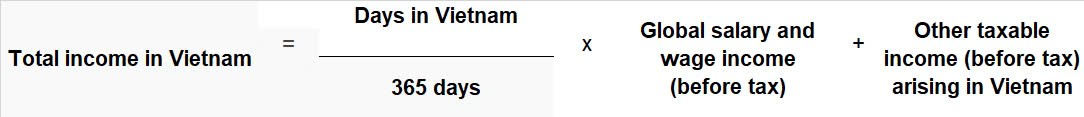

Determining personal income taxable income from salaries and wages in Vietnam in cases where non-resident individuals work simultaneously in Vietnam and abroad but cannot separate the income generated in Vietnam is implemented according to the following formula:

Case 1: For cases where foreign individuals are not present in Vietnam:

In which: Total number of working days in a year is calculated according to the regulations in the Labor Code of Vietnam.

Case 2: For cases of foreign individuals present in Vietnam:

Other taxable income (before tax) arising in Vietnam in the above cases are other benefits in cash or non-cash that employees receive in addition to salaries and wages paid by or on behalf of employees by employers.